It is impossible to move a centimetre without using steel in one of its many designs or shapes in our modern times. Steel is present in your kitchenware, structures, watches, vehicles, and even some of your electronic parts. Without steel, modern technology wouldn’t be in the manner it does. Each country must be able to produce it.

Making high-quality steel out of iron ore takes the highest level of craftsmanship and precision and not all firms are up to the challenge. Fortunately, the industry of steel in India is home to some incredible firms that have taken an unshakeable commitment to provide India and its citizens with only the highest quality steel. The list of steel manufacturers in India will assist you in deciding the best choice to meet your business requirements.

Tata Steel Ltd

Tata Steel is the second-largest producer of steel in Europe, with the capacity of its crude steel production of more than 12.1 MnTPA. In 2018-19, the company began the 5 MnTPA expansion plan in Kalinganagar to boost its overall capacity to 8 million tonnes of TPA. The Plant is known for its complete and affordable steel products all over India. Employers are chosen by their professional abilities, while the design team aids customers in preparing and executing their inventory needs. Steel mills are connected to rail, road, and air. Therefore, the transportation of goods and visits is easy for the employees.

JSW Steel Ltd

The first plant was established in 1982; JSW Steel is India’s leading high-quality and value-added steel product. JSW Steel manufacturing facilities are in Karnataka, Tamil Nadu, and Maharashtra.

Rashtriya Ispat Nigam Limited (RINL)

It is also called Vizag Steel as its headquarters is in Visakhapatnam. A prominent and well-known government entity, Rashtriya Ispat Nigam Limited, earns around $2 billion per year. This is proof that Rashtriya Ispat Nigam Limited has regular patronage from customers both within the country and abroad.

NMDC

NMDC, previously known as The National Mineral Development Corporation, is 100% owned by the state Indian mineral corporation. Around 73% of the company is controlled by the Indian Government, under the administrative oversight administered by the ministry for steel of India.

The company explores and produces copper, iron magnesium, natural phosphate diamond, limestone, and tungsten. At its inception, it was an exploration company for iron ore. However, as it began to diversify, steel production was the main focus after creating three Greenfield plants located in Karnataka and Chhattisgarh.

MONNET ISPAT Pvt. Ltd.

The company was founded in 1994 and became known later as Monnet ISPAT and Energy Limited (MIEL). It is a business established as an iron sponge and copper and steel marketing and manufacturing house in India. It operates an internationally renowned integrated steel plant located in Raipur, which produces slabs for greetings cards, human resources, and other products to meet the increasing infrastructure in India. The company claims to make steel economically by utilizing advanced technologies that cut down on the consumption of primary materials like coking coal and lumps of iron ore.

UTTAM GALVA STEEL LTD

Uttam Galva Steel is among India’s biggest cold-rolled and galvanized steel producers. Uttam Steel Plants was founded in 1985 and is located within Nagpur, Maharashtra. It is the leading producer of hot-rolled steel and later transforms it into galvanized and cold-rolled steel. There was the largest steel facility in India with an annual turnover of $. 44,963.8 million In 2009-10.

The Plant is also involved in the manufacture of coated steel rolls. This Plant is part of the Uttam Group and has two other manufacturing facilities operating within Wardha, Maharashtra. The goal is to increase steel production capacity at both plants within the next few months. A new steel plant that is integrated will be set up within Maharashtra’s Satara district by Uttam groups; however, it will be around 2023.

PRAKASH IND

Prakash Group of Industries is a specialist in manufacturing steel pipes and tubes, pipes, and U-tubes.PrakashSteelage is an extraordinarily stable and expanding industry of pipe and steel in India.

Prakash Steelage recently formed a joint partnership with the German steel manufacturer Tubacex which has worked on the technology. Prakash Steelage’s market share isn’t exclusive to India. Prakash Steelage Limited’s market is spread across North America, Southeast Asia, and Africa to Europe, the Middle East, and Europe.

MAH STEEL

Maharashtra Steel Manufacturing Company It was founded in 1985 and has become one of the top producers of steel products within Maharashtra and India’s Asian subcontinent. These comprise hollow section tubes, seamless tubes, carbon steel tubes, and welded boxes.

The company has earned trust thanks to the high-quality products that undergo rigorous testing before they are ready to be offered for sale. The steel pipes and the products made through the business are employed for their qualities of durability and dimensional stability, high capacity, strength, capacitive compatibility, and corrosion resistance. The company also provides free samples, various products, and convenient delivery options, making it a popular choice for steel companies in India.

KIOCL

KIOCL is among the largest and most efficient steelmaking businesses in India. And this company is listed among the top steel companies in India. It was previously called Kudremukh Iron Ore Company Limited when it was first established because it was initially an iron ore production plant. However, it soon became one of India’s biggest steel trading companies, changing its name. KIOCL was one of the biggest iron mines on the planet known, Kudremukh Mines, which was shut down by government officials of the Indian Government in 2006 after an issue.

rice trends of the specific steel firm as well as the more extensive construction and industrial market in which steel is an integral element. Steel is also a crucial component of the global automotive industry, and due to its various uses, it can be the 2nd most favoured product globally,

Presently, KIOCL is a wholly-owned subsidiary by the Indian Government. It was among the first companies to move minerals in the Western Ghats to the Mangalore palletizing plant using pipelines. The Plant is equipped with a capacity to manufacture 3.5 million tonnes of steel annually, and the market is spread across Japan, Taiwan, Iran, and China.

Jindal Steel and Power

Another patron of this Jindal Company, Jindal Steel and Power, is now a significant steel player in the private market. It is known for its many items, but most notable are The Jindal Panther TMT bars it has been betting on future since its inception.

Jindal Steel and Power have not only achieved significant progress within market share in the Indian industry, but they have also expanded into other markets. In Africa, The Company started its activities in key cities like Melmoth, Botswana, Madagascar, Namibia, and Senegal (among other cities). As time passes, Jindal Steel and Power will grow exponentially and provide prosperity and business opportunities to the nation.

What is a stock of steel?

Steel stocks represent an element of the ownership of a publicly-traded steel company. Anyone can purchase steel stocks from retail investors to established institutions and banks.

A steel stock provides an opportunity to be exposed to the following crude oil.

Steel is also an excellent instance of a cyclical stock because its performance is closely linked to the economic environment. In an economic downturn, the steel demand would decrease due to lower spending on construction and other major drivers of the growth of steel from public and private corporations. In an economic boom, there will be an increase in demand.

Are steel-related stocks a good choice for investment?

Steel is typically an intelligent investment in the beginning stages of growth during the bull market. If you can start early when demand for steel rises, you may reap a vast reward. However, if the economic climate shifts to the other side, the steel market will likely follow.

Demand for the best steel company in India across the globe is currently at over 1,850 million tonnes and is expected to increase, particularly as emerging economies boost their spending.

Therefore, the macro-history of steel is among the most reliable narratives of the whole commodity trade as the long-term viability of its utility and the power of the steel industry are unquestionable. Many analysts anticipate steel to be a strong performer over the next few years as global economies are boosted by increased spending.

How technology and training can make India’s steel re-rolling industry greener

With a booming economy, the demand for construction materials has skyrocketed in India. In particular, the need for steel has increased in recent years, with production registering a compound annual growth rate of around 7% in recent years. While the steel industry is a vital part of India’s economy, it is also responsible for large amounts of waste and greenhouse gas emissions. Steel production is very energy-intensive, and energy efficiency processes have yet to be integrated into the daily operations of Indian steel mills. But that is changing.

You were delighted to participate in an energy efficiency project for the steel rolling sector in Bhavnagar, a medium-sized town in the western state of Gujarat. Bhavnagar is home to the largest cluster of steel rolling mills in Gujarat. Like other steel rolling mills, the group creates everyday products such as bars and structural steel by rolling heated material in a rolling mill.

Overall, the sector depends on raw materials such as ingots, billets, and various types of scrap, but in Bhavnagar, 80% of the rolling mills use steel sheets from recycled ships from Alang, one of the largest shipbreaking yards in the world. In 2011-2012 alone, the yard handled 415 ships (3.86 million tonnes) and provided direct employment to 50,000 people and indirect employment to thousands of workers.

It started in earnest in 1928, and there are about 1800 factories in operation in India. The sector is primarily dominated by small and medium-sized enterprises (which account for 75% of the industry), which enjoy a competitive advantage over large producers thanks to their flexibility in producing small volumes for niche markets.

However, the efficiency of these small units is woefully low, leading to substantial energy losses and a significant waste of raw materials. There is a tremendous opportunity to save resources by reducing the use of fuels and raw materials by modernizing technologies. Large-scale action would also significantly improve the pollution load (locally and globally) and improve the working environment.

You worked with a steel rolling group that sourced scrap from the Alang shipbreaking yard to demonstrate this potential. The group’s primary fuel source is pulverized coal, a dirty fuel that produces large amounts of greenhouse gases and pollution when burned. You choose to work with the cluster because of its potential to reduce its CO2 emissions through energy efficiency measures, including improving the design of its poor kiln to reduce the use of coal.

Other challenges have hampered their ability to conduct effective operations – many of which are not confined to this city alone. The majority of factory owners are first-generation industrialists without any formal technical training. Even the factory foreman and staff did not receive proper training but learned their skills on the job.

In general, the steel rolling industry also faces several market failures, with limited access to finance technology and market information. The absence of effective systems aggravates this situation to support the adoption of cleaner production at the industry level.

To help overcome these hurdles, you carried out a feasibility study and, armed with better information, helped improve the cluster’s design and operation of a reheating furnace. Other steps have been taken to ensure proper management of the new technology, including training operators and mill supervisors, monitoring improvements, and partnering with the Shihor Steel Re-rolling Mills Association to provide support. Continuous to the cluster. It is important to note that you also helped identify a financial partner to ensure the initiative’s success.

Thanks to the top steel company in India, the thermal efficiency of the kiln have increased from 21% to 30.5%, and fuel consumption has decreased by 23%, which in absolute terms is equivalent to 75 kg per ton of product, compared to 97 kg per tonne of product. Each year, the improvements saved 330 tons of coal.

Bhavnagar steel rolling mills are not alone in having inefficient technologies and not being aware of energy efficiency. If replicated across India, this model could contribute to vast reductions in CO2 emissions – meaning the sector could maintain its strong economic position while greening its production. A high energy cost encourages opting for less energy-intensive solutions and recycling steel already used.

To remain competitive, the steel industry is highly dependent on the cost of energy, which explains why the United States has maintained high production despite intense competition from Asia (the competitive advantage provided by shale gas remains a valuable asset). The manufacturer of steel, the competitiveness of energy prices is a determining factor in the choice of investments and site locations of steel groups.

Changing the energy mix used in production focuses on gradually getting rid of fossil fuels. Biomethane and hydrogen have been identified as credible alternatives to replace hydrocarbons but, according to estimates by Carbone, these solutions would only reduce the carbon footprint of steel production by 10%.

In 2018, 27% of the steel used in the world came from recycled sources, with disparities between the different consumer sectors. The construction could only use recycled steel, whereas the automobile industry has specific requirements for its flat steel, which is difficult to recycle.

According to Carbone 4, betting on 80% recycled steel by 2050 seems realistic, provided, however, the collection channel is organized. It will also be necessary to reduce production by 15% by 2050 compared to its 2018 level so that the industry is in line with the objectives of the Paris Agreement of 2015 aimed at limiting global warming well below 2°C by the end of the century.

To date, the solutions recommended above are only deployed marginally. European countries, having witnessed the decline of their steel industry over the past 50 years, have recently implemented policies promoting recycling and investing in R&D to move upmarket. Emerging countries still seem reluctant to modify their production methods, which, in the long term, could give the European Union a real advantage.

Conclusion

The steel industry is expected to experience moderate demand growth over the next decade due to a slowdown in global growth and Chinese domestic demand. The good health of other markets, such as India, will not be enough to absorb the excess supply in a context where the latter will remain higher than demand, driving down prices and thus constraining producers on their margins.

The best steel company in India will also have to fight against climate change by drastically reducing its GHG emissions to achieve carbon neutrality objectives. To achieve this, the modification of the energy mix, the development of the recycled steel sector, and a reduction in global production will be necessary. The steel sector will remain risky for investors, who will have to consider environmental standards and energy costs when choosing future production sites.

Also Read: Learn Forget

Top 10 Highest Waterfalls in the World

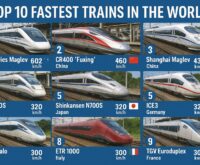

Top 10 Highest Waterfalls in the World  Top 10 Fastest Trains in the World

Top 10 Fastest Trains in the World  Top 10 Highest Waterfalls in the World

Top 10 Highest Waterfalls in the World