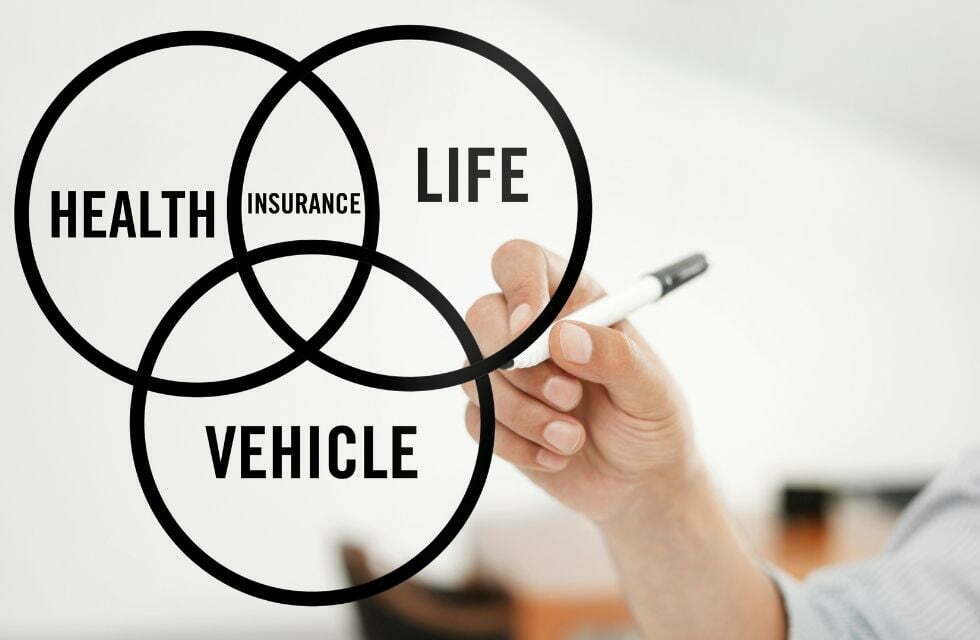

Life is unpredictable. We don’t even know what is going to happen to us in the next minute, so there is no chance of predicting what’s coming in the upcoming years. And that makes insurances relevant and useful for us. Let’s get to know about insurance types, coverage, and policies.

Basics and Insurance types

Insurance is the key to protection from money or capital loss in the future due to accidents or uncertain incidents. Though there are a huge number of insurance types, we’ll talk about those in the latter parts. It’s a form of risk management.

Let’s talk about some basic terms of insurance.

An entity commonly called an insurer provides insurance. And the person who buys it is known as the policyholder. The entity which is covered is termed as insured.

The contract which states all the details of terms and conditions under which the losses will be compensated and up to which extent is named insurance policy.

Let’s see what is insurance coverage?

Insurance coverage is another term that defines the amount of risk, liability or potential loss, which are covered and the insurer helps to recover the loss due to unlikely incidents. The policyholder has to pay some charges to the insurer regularly which is called premium and the policyholder can claim the insurance money or compensation if the insured faces a loss.

History of Insurance and Risk Management

The history of risk management and insurance is not so short. It’s been going on for a long time. Methods of distributing risk money were practiced by the traders from Babylon, India and China. Concepts of insurance are also seen in the ancient scriptures of Hindu mythology.

The direct insurance for the risks in the sea was initiated in Belgium in 1300 AD. Separate insurance contracts were invented in Genoa in the 14th-century for the landed estates. But the concept of life insurance came into action on 18th June in the year of 1583. This was made in Royal Exchange, London.

Insurance Types

There are several types of insurance. But generally, we classify in two major types and these categories have their sub-categories. The two major types are

- General insurance

- Life insurance

General insurance

It includes almost every kind of insurance except insurance which is related to anyone’s life plans. For example, insurance related to health, car, home etc.

Health insurance: This particular type of insurance takes care of the health of the insured person or family. This will help you during the whole treatment process. You will be supported by this plan from getting hospitalized to daily care, medical bills or most importantly during the treatment of the critical illness, treatment of which is generally costly.

There are too many plans to offer you regarding health insurance. You may choose individual insurance for any particular person’s health or family floater insurance which will benefit the whole family. This generally includes husband, wife, and two children. Be it for senior citizens or a group of people, there are separate kinds of insurance. Maternity insurance is also there to be by your side from the prenatal stage to the delivery stage, both for the mother and the newborn.

If you are suffering from a critical illness, the critical illness cover policy may help you to overcome it.

Motor insurance: There are insurance policies to compensate for the unfortunate incidents your favorite car may face. For your car or your bike, you can have different insurance. If you are an owner of commercial vehicles like trucks etc., you must have the insurance done, as it runs the economy of your home.

Home insurance: This insurance policy will offer you protection against the enormous loss you may face due to damage to your home. You can get compensated for the damages to your home structures, public liability, personal damage. You will also be able to be protected from the loss you may have due to robbery or burglary.

Fire insurance: Fire is bane and boon altogether. It may cause severe damage. But if you are smart enough to buy fire insurance, you will be secured from the huge loss due to the damage and can get compensation from the insurer.

Travel insurance: If you also love to explore this beautiful world, you must know about travel insurance. This is available for domestic, International, individual, group, any type of trip. It’ll give you support if any unpleasant incident happens.

Life insurance

It is more likely to be involved in the life goals and the plans.

Term life insurance: This is probably the most common and affordable insurance. It’ll take care of the family in case any mishap happens.

Whole life insurance: This is for your whole life. The person has to bear the premium until some limited time and your family will get the money after the person passes away and it’ll take care of the family. Even after a hundred years, the policyholder will get maturity benefits too.

Endowment plans: This plan helps to come up against the uncertainty of life. This allows one to save regularly and after a fixed period, once it matures, the person will get the lump sum of the money. And if death comes before, the family will get coverage and get some support.

Child plans: There are several plans made for protecting your children too. You can buy insurance for your child to make his future more secure against the uncertainty.

Retirement plans: This is also known as a pension plan. You have to pay the premium until some fixed period and this will offer you the continuation of the flow of a steady income after your retirement.

Inference

As we discussed so many insurance types in the above portions, you’ll be amazed to know that these were only a few of them. In this world full of uncertainty, we should never bet on our and our family’s life and future. So be smart enough to buy insurance and be safe.

Because when it comes to our and our family’s lives and future, making it safe and beautiful is the best you can do.

Top 10 Highest Waterfalls in the World

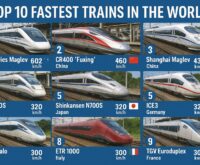

Top 10 Highest Waterfalls in the World  Top 10 Fastest Trains in the World

Top 10 Fastest Trains in the World  Top 10 Highest Waterfalls in the World

Top 10 Highest Waterfalls in the World