Medicines are essential for the health and survival of people. With sales exceeding 600 billion dollars, the pharmaceutical sector is constantly growing, characterized by competition based on product dependency. Its competitive strength is based on research and development. About 12% of the industry’s revenues are allocated to appropriation rents through the patent system and marketing chains.

In recent years, there has been a considerable increase in interest in studying current drug trends worldwide, the transnationalization of the pharmaceutical industry, and the impact of multilateral agreements on trade and intellectual property rights worldwide. Fundamentally the proliferation of HIV/AIDS infection in many of the world’s poorest countries, the misuse of antimicrobials, and radio nuclear or toxic threats.

Infectious diseases are now spreading geographically much faster than at any other time in history. A situation made more complex because basic antimicrobials are beginning to fail much quicker than developing new drugs to replace them. Currently, at least 40 diseases were unknown a generation ago, and numerous epidemic events have been reported worldwide.

However, this is not manifested to the same extent in all world regions. Clear examples of this are the letters with spores of the anthrax bacillus (B. anthracis) in the United States in 2001, the appearance of SARS in 2003, and the massive spill of toxic chemical waste that occurred in Côte d’Ivoire in 2006, among others. All this implies new challenges for the pharmaceutical industry and health services worldwide.

Because of the COVID-19 pandemic, the availability of healthcare facilities and drugs are now the order of the moment. The Indian pharma industry is expanding and changing lives by providing the necessities. In the estimation of the Ministry of Chemicals and Fertilizers, the revenues of pharmaceutical firms that operate in India reached 18.12 billion dollars in the year 2018. The market for Indian drugs saw sales of 2.15 billion US dollars by April 20, 2021. It is up 51.5 percent from $1.42 billion during April of 2020. The average annual turnover of $20.88 billion in April 2021 increased by $19.64 billion as of April 2020.

Generic drugs manufactured by the top ten pharma companies in India account for 20 percent of the world’s exported goods in volume, which means that India is the biggest supplier of generic medicines worldwide. The Indian pharmaceutical market will reach 33.18 billion dollars and rise to 9th place in the world pharma market by 2023. With its skilled workforce and low production costs, India has gradually established its place as the centre of the pharmaceutical industry.

This growth is due to the long permissive law on patents and the invention of reverse engineering. This is the capacity to degrade a molecule to recreate it. The pandemic has brought India to the centre for the industry of pharmaceuticals. The country is home to a skilled workforce; however, the infrastructure is not meeting the world’s demand. How does the Covid crisis reveal the strengths points of the Indian industry?

India has decided to hold the doses to its population despite the rising number of cases within its territory. This is why India has asked, at the time, but without much success, for the removal of patents related to other vaccines. However, this pandemic questions India’s capacity to produce beyond intellectual property issues. Although the country has a skilled labour force, it is unclear if the infrastructure can handle this massive global demand.

Below is the list of top 10 pharmaceutical companies in India.

Sun Pharmaceutical Industries

This is among the top 10 pharmaceutical companies in India. It was started by Mr. DilipShanghvi, the CEO of Sun Pharmaceuticals. The company began offering medications to treat mental disorders. Today, the company provides different treatments, including gastroenterology, therapeutics, and diabetes-related conditions.

It is also the fourth largest worldwide speciality generic pharmaceutical firm around the globe. This pharmacy business deals with reasonably priced medicine in more than 150 countries on six continents.

Divi’s Laboratories

Divi’s Laboratories Ltd. Mainly manufactures active pharma ingredients (APIs) and products and is among the top ten pharma companies in India. The pharmaceutical firm located in India is involved in Manufacturing world-class generic ingredients, Nutraceutical components, and custom-made API synthesis and intermediates for world-class innovative companies.

Dr. Reddy’s Laboratories

It is known for producing various pharmaceuticals both in India and abroad. There are more than 190 drugs and 60 active pharmaceutical components for manufacturers of diagnostics kits, biotechnology, and critical care products.

Cipla Limited

This pharmaceutical firm located in India is focused on developing treatments for respiratory, arthritis, cardiovascular diseases as well as diabetes, weight loss, depression, and others. Cipla is expected to earn $2.5 billion by 2023 and employs more than 22 036 employees. The subsidiary companies of Cipla include Invagen Pharmaceuticals.

Biocon Limited

In 1978, this India’s top pharma company was founded; Biocon is the most well-known pharmaceutical manufacturer in India. Biocon Limited is a manufacturer of essential active pharmaceuticals. The company is located in Bengaluru. The products of Biocon Limited are distributed around the globe at a vast scale. Biocon employs over 9000 people, and the company has assets worth more than $824 million, and the revenue was $659.31 million (INR 4885.5 crores) at the end of FY20.

Torrent Pharma

It is among the top pharmaceutical firms in India. It is located in Ahmadabad. It makes medicinal drugs for the Central Nervous System and gastrointestinal diabetes pain management anti-infective segments.

Lupin Limited

It is a multinational pharmaceutical company in Mumbai. Lupin was founded in the year 1967 by DeshBandhu Gupta. The company is the 13th biggest company by market value. Lupin is estimated to make $2.2 billion by 2023. Lupin has been involved with the manufacture and sale of medicines that range from cardiovascular, paediatrics, diabetology, anti-infectives, and anti-tuberculosis.

Cadila Healthcare Limited

Cadila Healthcare Limited was established in 1952. It is also called ZydusCadila. ZydusCadila is an Indian pharmaceutical company with its headquarters in Ahmedabad. It is among India’s most prominent pharmaceutical businesses and is expected to earn a profit of US$2.1 billion by 2023. It was established through Ramabhai Patel.

Cadila Healthcare Limited is well-known for its diagnostics and producing natural, skincare, and OTC products. It also makes standard medications used in hepatitis C treatment based on a voluntary licensing arrangement with Gilead.

Aurobindo Pharma Limited

It offers over 300 different products in 150 countries. Its most important segment is APIS which accounts for 35% of its total revenue comes from API. It is the second-largest pharmaceutical firm in India and will earn a profit of US$3.3 billion by 2023. It is engaged in Manufacturing and distributing medications in cardiovascular, neurosciences, antiretrovirals, anti-diabetics gastroenterology, and cephalosporins.

Intas Pharmaceuticals Limited

It is currently operating with an income of $1.49 billion by 2022. It is the home of 13 commercially available biosimilars, comprising Docetaxel and Paclitaxel. The pharma company located in India is home to an R&D department in chronic diseases of oncology (cancer) and rheumatology. It is used in autoimmune, nephrology, ophthalmology, and plasma-derived treatments.

The pharmaceutical company has its headquarters located in Ahmedabad and is among the top biosimilar manufacturers in Asia. Intas has 14 manufacturing facilities, seven of which are within India and located in the UK and Mexico. It is the seventh most prominent firm headquartered in India.

A multi-faceted career

The representative for pharmaceuticals is to sell and present products for hygiene, health, cosmetic and dietetic health products, and medical equipment at the request of health experts. These comprise pharmacists, Para pharmacy management dentists, doctors, medical teams that work in clinics, hospitals general or specialized practices, and veterinarians. They create a strategy and a commercial plan based on the guidelines of the sales department within the context of regulations for pharmaceuticals. With their work that combines commercial methods and scientific and medical information; Pharmaceutical representatives have an eye transversal to most health-related professions.

They work for an organization like a lab or health firm, working in the sales force to ensure that its products are readily available to customers via health experts. This job involves spending much time on the ground, meeting customers, creating new products, negotiating, and doing necessary follow-ups about orders.

The representative for pharmaceuticals is an advisor who helps promote the company’s research activities, showcases the latest developments, and responds to questions from contacts. They also have to manage the prospects, create their client portfolio, plan their visits to the field and build loyalty among customers so that the products offered by the laboratory represents are recognized, recognizable, and included in the recommendations of health experts.

The fundamental qualities required to become an official representative for pharmaceuticals. As with all trades related to commercial activities, it is vital to have human qualities. The pharmacist’s representative should be warm, attentive, understanding, and responsive to establish an ongoing relationship of trust with his clients.

In the field or at the office, the employee must be organized, autonomous, and attentive to the market, no matter if it is the latest requirements of his customers and the behaviour of rivals. A strong sense of sales and a desire to face new challenges are vital assets. Also, they must understand science and a predisposition to medicine.

Selling medical or pharmaceutical products requires communication with highly skilled specialists in a particular area, such as doctors or pharmacists, for instance. It is crucial to be aware of the challenges faced by these various trades, to be mindful of how they function and clearly understand the requirements of these trades.

Development of the career path for the pharmacist representative

After a positive experience in the area, the pharmaceutical representative may advance his career in the medical field in sales management or regional management and trainer or account manager roles. An opportunity to grow vertically to positions of responsibility allows them to supervise teams and help less experienced salespersons.

The employee can also shift to marketing at times, after a brief course, depending on the background and the design, management, and control of promotional and marketing campaigns on the product’s side.

Indian generic competition and accessibility of anti-AIDS treatments

In India, the production of antiretrovirals began in 1991. At that time, the Indian pharmaceutical company Cipla cautiously produced the least expensive antiretrovirals, with low active ingredient content, and the manufacturing processes were less complex. Five Indian firms make antiretrovirals a decade later, and more than fifteen treatments (mono-, bi- and triple therapies) are sold worldwide.

The entry of these generic drug manufacturers into the antiretroviral market in 2001 caused a drastic drop in treatment prices. This decline began with the announcement made in February 2001 by Cipla to sell its therapy in the form of a cocktail (the Triomune) at 350 dollars per year and per patient to non-governmental organizations (NGOs). On the date, triple therapy costs 931 dollars under the originator.

In addition, competition between Indian generic drug manufacturers is causing further price reductions. Two months after Cipla’s announcement, Hetero launches into the race and declares selling the same cocktail at 347 dollars to NGOs. A few months later, Ranbaxy offered the cocktail to the NGOs for 295 dollars. Since then, prices have continued to fall.

Hetero sold his tritherapy at 152 dollars against 562 dollars under originators. Undoubtedly, generic competition has proven to be the surest way to bring down the price of treatments. Suppose you wonder about the driving forces behind the performance of the Indian industry. This version is the source of considerable progress in access to anti-AIDS therapies worldwide. In that case, you find a flexible patent policy, adopted in 1970.

The institutional drivers of Indian industrial and health progress

In the aftermath of independence, the Indian pharmaceutical industry was in its infancy, and the country remained heavily dependent on the external supply of drugs. Very quickly, the IPR regime was incriminated. The Indian Patent Act amended in 1911 establishes a robust IPR regime, which authorizes the granting of patents on both processes and products for 16 years. This period can be extended by ten years if the patent holder is reimbursed for his innovation.

As early as the late 1940s, experts consider India’s IPR regime to have failed to stimulate industrial innovation development and promote the general interest. On the other hand, it allowed the multinational companies of the North to obtain positions of monopoly and to practice prohibitive prices. Therefore, it is recommended to establish a new institutional arrangement: a more flexible IPR regime and fairer pricing measures (” fair selling price “) to promote the development of a national industry capable of ensuring self-sufficiency.

Country’s health system and to improve access to medicines. India’s top ten pharma companies provide that patents will be issued only for manufacturing processes for seven years. A company may enjoy a single patent for an operation. From now on, medicines will therefore be excluded from the scope of the patent. Finally, if, after three years, a drug is still not available within a reasonable time or at an affordable price, the government may consider that the needs of the public are not met and issue a compulsory licence.

It will authorize a local company to produce a copy of the drug and market it lower. The same year, the Drug Price Control Order was introduced. Thus, based on reverse engineering and learning by copying, companies market cheaper generics of drugs patented abroad by multinational corporations in the North. First, a fragmented national pharmaceutical industry has developed. Today it has 20,000, including 260 large units. In addition, pharmaceutical production has dramatically expanded. The production of raw materials rose from 180 million rupees to 60 billion between 1965 and 2003.

That of drugs recorded more significant growth, increasing from 1.5 billion rupees at the end of the 1960s to 230 billion in 2003. As a result, the sector exports advantageously to the rest of the world, both raw materials, and medicines. In 2003, the surplus amounted to more than 140 billion rupees. In short, non-existent at the start of the 1970s, the Indian pharmaceutical industry grew at 13.7% per year over the period 1970-2003.

Its production currently amounts to 8 billion dollars, ranking it 4th in volume and 13th in value. The country’s health self-sufficiency and the accessibility of medicines have improved significantly. On the one hand, the industry manufactures 70% of the raw materials and 80% of the drugs available on the Indian market. In 2003, the sale of narcotics amounted to 4.3 billion dollars on the domestic market, 75% of sales being made by national firms.

On the other hand, the comparison between the price index for drugs and the price index for other goods over the period 1961-1989 reveals the favourable effects of the DPCO. At the beginning of the 1960s, there was 2% inflation for drugs, against 3% for all goods. By making its IPR system more flexible, India has supported the development of a pharmaceutical industry capable of producing more affordable generic drugs. Top pharma companies in India have made it possible to drive down the price of medicines and significantly improve their accessibility.

Top 10 Highest Waterfalls in the World

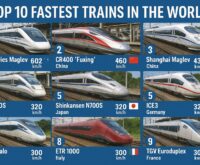

Top 10 Highest Waterfalls in the World  Top 10 Fastest Trains in the World

Top 10 Fastest Trains in the World  Top 10 Highest Waterfalls in the World

Top 10 Highest Waterfalls in the World